President Yoweri Museveni has given the green light to the ongoing Parliament probe into Bank of Uganda’s sale and takeover of commercial banks. This follows Finance Minister Matia Kasaija’s proposal to have cabinet halt the probe.

Reports indicate that during Monday’s cabinet meeting that was chaired by President Museveni, Kasaija sought cabinet protection of BoU, reasoning that the probe into BoU matters would negatively affect the financial sector.

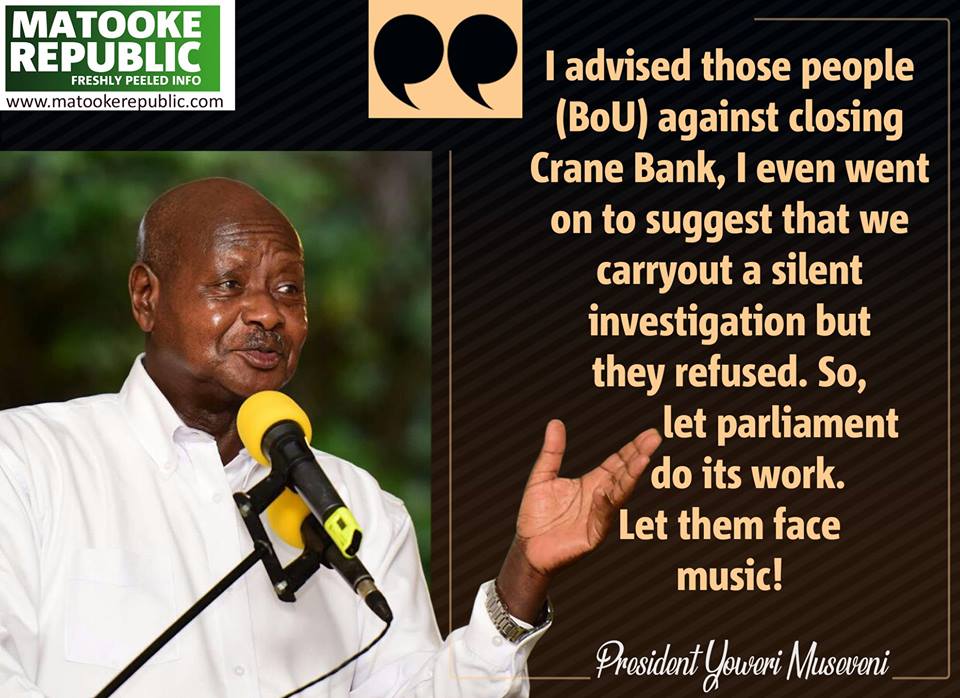

President Museveni however said the probe should go on because he tried to restrain BoU officials from closing Crane Bank that was owned by tycoon Sudhir Ruparelia but they didn’t listen to him.

“I advised those people (BoU) against closing Crane Bank. I even went on to suggest that we carry out a silent investigation but they refused. Let Parliament do its work and let them face the music,” the president reportedly told Cabinet.

The ongoing probe by Parliament’s Committee on Commissions, Statutory Authorities and State Enterprises follow’s an Auditor General’s stinging report into the closure and takeover of seven commercial banks that pointed at possible corruption within BoU.

The banks include Teefe Bank (1993), International Credit Bank Ltd (1998), Greenland Bank (1999), The Co-operative Bank (1999), National Bank of Commerce (2012), Global Trust Bank (2014) and the sale of Crane Bank Ltd (2016) that was controversially sold to dfcu in January 2017.

Several BoU officials have so far appeared before the probe including Governor Tumusiime Mutebile, Deputy Governor Loius Kasekende, the director of Financial Markets Development Coordination Benedict Ssekabira and former Executive Director in Charge of Supervision Justine Bagyenda.

So far Bagyenda has been crucified as guilty by the court of public opinion following revelations of how she “stole” vital documents from the bank that were supposed to be integral in the probe and how she fled the country during the probe only to resurface after COSASE Chairman Abdu Katuntu issued an ultimatum for her to re-appear or face arrest. Currently, she is on a travel ban as her travel documents have been confiscated by Parliament.

Bagyenda has also been faulted for irregular sale of Gold Trust Bank to DFCU. Meanwhile, Ssekabira failed to present evidence of reports on how the value of assets of three closed commercial banks assessed so far, was reduced from Shs117b to Shs98b after the Central Bank took over the liquidation.

Bagyenda is also in the dock for instructing DFCU to keep Crane Bank’s Shs600b bad loan book off the records.

The BoU officials are also being tasked to account for Shs498b they allegedly pumped into Crane Bank when it was put under receivership and why they later sold it for a paltry Shs200b to DFCU.