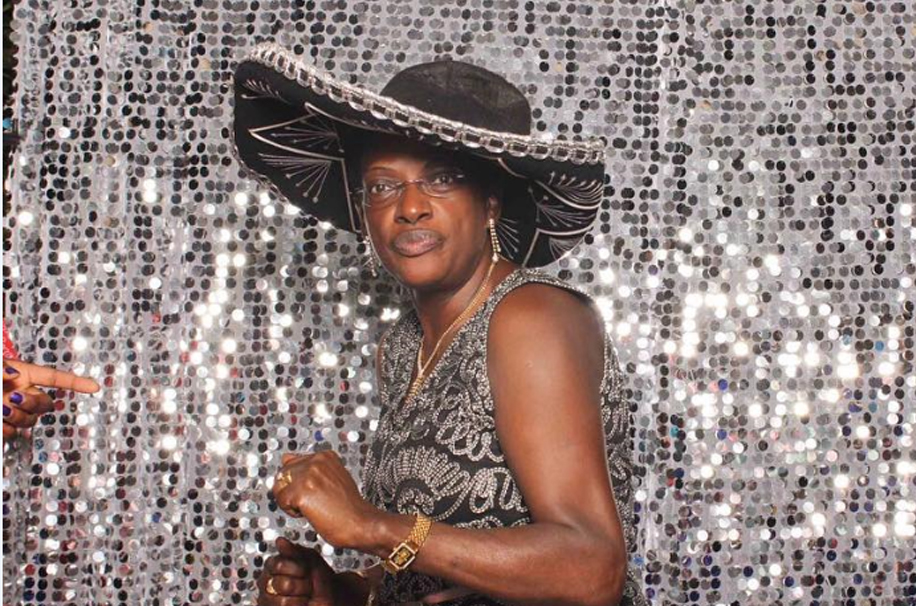

The last time Justine Bagyenda, the former Executive Director for Supervision at Bank of Uganda was supposed to appear before Parliament it was for her own good as she was supposed to be vetted for renewal of her appointment on the Financial Intelligence Authority board. However, due to the controversies surrounding her including allegations of illicit enrichment and money laundering, she chose to stay home, informing Parliament that she was out of the country.

This time however, she has been summoned by Parliament and she must show up, worse still when the summons are not in her own good because the committee on Commissions, Statutory Authorities and State Enterprises investigating irregularities in the closure of seven commercial banks, wants answers on how Crane Bank Ltd loans amounting to Shs600b were written off during its sale to DFCU Bank.

Bagyenda is to answer questions regarding unilateral waiving of the Financial Intelligence Authority (FIA) rules for dfcu Bank to evade loan regulations when it took over Crane bank in January 2017.

Ms Bagyenda, wrote to dfcu Bank Managing Director Juma Kisaame, giving the bank several waivers to evade FIA rules, including allowing dfcu Bank 60 days to integrate assets of Crane Bank Ltd, and to report separately on the assets acquired and liabilities assumed from the controversial transfer.

“The non-performing loans and advances acquired by DFCU will be managed and reported on separately from DFCU’s per-transaction balance sheet for the period of at least 12 months,” Bagyenda wrote.

“All fully provisioned and advanced acquired by DFCU will be ring-fenced and managed separately and will not be part of the DFCU loan portfolio for reporting purposes until rehabilitated in conformity with the Financial Institutions Regulations, 2005,” she wrote.

Bagyenda will be questioned alongside DFCU Bank directors, including the Chairman Mr Jimmy Mugerwa.

The MP’s inquiry came up after the Auditor General report on the closure and takeover of seven banks pointed at possible collusion and fraud among DFCU officials. The banks include; Teefe Bank (1993), International Credit Bank Ltd (1998), Greenland Bank (1999), The Co-operative Bank (1999), National Bank of Commerce (2012), Global Trust Bank (2014) and the sale of Crane Bank Ltd (CBL) to dfcu (2016).