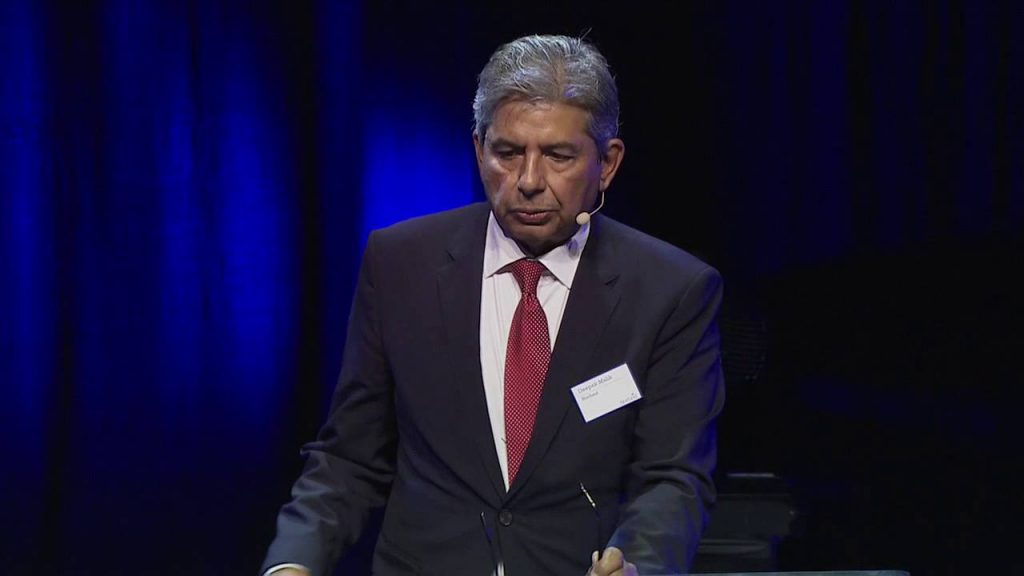

It looks like DFCU’s acquisition of Crane Bank was built on a pack of cards and they are now tumbling down. On the heels of major shareholder, British government owned CDC pulling out, Deepak Malik, the chief executive of Arise BV, the majority shareholder in DFCU bank with 58.71% ownership, has tendered his resignation as a member of the DFCU board.

Both CDC and Arise BV came under fire over the controversial take over of Crane Bank that was summed as fraudulent by economic and legal analysts.

The reasons for Malik’s resignation are not immediately clear, but sources indicate it is linked to the Crane Bank takeover that has left DFCU entangled in legal webs as guidelines stipulated by the Financial Intelligence Authority were not followed, on top of breaching several contractual obligations it inherited from Crane Bank.

Malik who is the Chief Executive at Arise B.V. heads the department of financial institutions and is part of the management team at Norfund the Norwegian government owned firm that is the parent company of Arise BV. His role covers Africa, South Asia and Central America. He joined Norfund as an Investment Director in 2003 where his efforts were spent in promoting Norwegian investments in Southern Africa and the region.

With 35 years’ experience, Malik was previously the Regional Director of South Africa at Norfund. He has started his career at SIEMENS (India) in 1982, after which he opened a private consultancy in 1984, specialising in financial services. He was then appointed as audit manager for KPMG in 1988, following which he became Financial Director for ZAL HOLDINGS (Ltd) – a subsidiary of Zambia Consolidated Copper Mines Limited.

Previously, Malik’s vast experience included his roles as a Managing Director and Chief Executive Officer at the Development Bank of Zambia, as a General Manager at Zambia Consolidated Copper Mines and as an Audit Manager at KPMG. He serves as the Chairman of AfriCap Microfinance Investment Company.

He is on the Board of Directors of various companies, including financial institutions and private equity funds. He is a Non-Executive Director of Real People (Pty) Ltd. since July 20, 2011.

He serves as a Non-Executive Director at Equity Group Holdings Limited. He is a Non-Executive Director of Equity Group Holdings Limited since April 29, 2015. He had served as a Non-Executive Director of Real People Investment Holdings Limited since May 28, 2015. He served as a Board Member of Norwegian Microfinance Initiative. He served as a Director of NMBZ Holdings Limited and NMB Bank Limited from January 31, 2014 to October 22, 2014.

His specialization is working with multilateral/bilateral financial institutions and he also has an extensive knowledge of developing countries. He is a qualified Chartered Accountant. He holds a Bachelor of Commerce (Honors) from the University of Delhi, India.

Crane Bank “ghost” continues to haunts DFCU

Bank of Uganda sold Crane Bank to DFCU in January 2017 for a paltry Shs200 billion yet it was valued at over Shs1.3 trillion. Following the leaking of the agreement, it was revealed that DFCU didn’t even pay a cent.

Crane Bank shareholders were also side-lined during the sale, disregarding to Financial Intelligence Authority regulations.

As CDC pulled out of the bank, Malik also tendered his resignation leading to analysts to speculate that there is something really stinking in the Crane Bank deal, that DFCU management previously termed as a sweet deal.

It should be recalled that DFCU’s profits rose from Shs31 billion to Shs150 billion just three months after taking over Crane Bank. Now the bank is beginning to vomit for chewing more than it can swallow.